Ethereum Price Prediction: Analyzing the Path to $5,000 and Beyond

#ETH

- Technical Strength: ETH trading above key moving averages with strong institutional accumulation supporting current price levels

- Catalyst Driven: Upcoming Fusaka hard fork and Layer 2 developments providing fundamental growth drivers

- Long-term Value: Institutional adoption and network upgrades positioning ETH for multi-year appreciation cycle

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

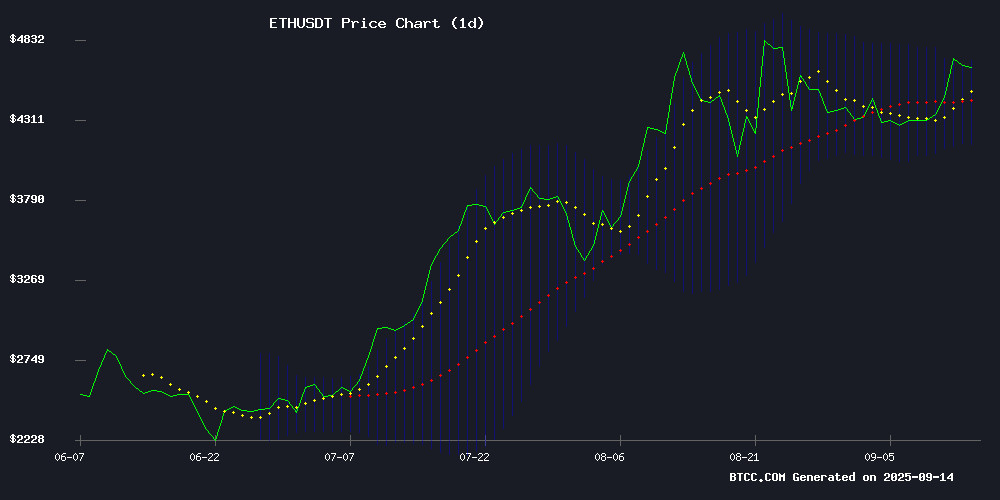

Ethereum's current price of $4,661.25 sits comfortably above its 20-day moving average of $4,424.23, indicating sustained bullish momentum. The MACD reading of 46.35 versus its signal line at 88.56 suggests some near-term consolidation, though the overall trend remains positive. Robert from BTCC notes that ETH is trading NEAR the upper Bollinger Band at $4,697.52, which typically acts as resistance but could signal continued strength if breached.

From a technical perspective, the positioning above both the middle band and 20-day MA provides strong support around the $4,424 level. Robert suggests that maintaining this level could pave the way for testing the $4,700 resistance zone in the coming sessions.

Market Sentiment: Institutional Accumulation Drives Ethereum Optimism

Recent whale activity and institutional purchases, including Bitmine's $201 million ETH acquisition, are creating strong fundamental support for Ethereum's price trajectory. Robert from BTCC emphasizes that the combination of Nasdaq-listed companies expanding their ethereum reserves and growing institutional demand aligns with the technical bullish outlook.

The upcoming Fusaka hard fork and LAYER 2 developments, particularly Ronin Network's OP Stack integration, provide additional catalysts for medium-term growth. Robert notes that while the Layer 2 landscape is becoming crowded, the underlying network enhancements continue to strengthen Ethereum's market position.

Factors Influencing ETH's Price

Whale Accumulation and Retail Interest Fuel Ethereum's Bullish Momentum

Ethereum trades steadily between $4,400 and $4,420, underpinned by $9.2 billion in whale accumulation. Institutional confidence grows around ETH's DeFi dominance, Layer-2 scaling, and real-world asset tokenization narratives.

Technical analysis identifies $4,800-$5,000 as critical resistance, with a breakout potentially propelling ETH toward $5,500. Support holds firm at $4,200-$4,300, shielding against deeper pullbacks.

Retail investors diversify into presale projects like MAGACOIN FINANCE, viewing them as complementary bets to core ETH positions. The market watches for regulatory clarity as a potential catalyst for the next leg up.

Ethereum Price Prediction: Analysts Eye $5,000 Breakout Amid Altcoin Momentum

Ethereum flirts with $5,000 as institutional inflows and technical patterns signal potential upside. The second-largest cryptocurrency by market cap recently tested all-time highs near $5,000 before consolidating between $4,200-$4,500. Market observers now anticipate a decisive breakout, with some charts suggesting a path toward $10,000 in the current cycle.

The altcoin market typically mirrors Ethereum's strength. Analysts note that ETH's sustained rally could trigger capital rotation into smaller-cap tokens. Three projects have emerged as top contenders for this potential spillover effect, though the report didn't specify which altcoins made the cut.

Notably, accumulation strategies by institutional players like Tom Lee's BitMine draw comparisons to Michael Saylor's Bitcoin acquisition playbook. This institutional endorsement adds fundamental weight to Ethereum's technical bullish case.

Ethereum Holds Steady at $4,600 as Rollblock Gains Traction with 500% Presale Surge

Ethereum's price stability above $4,600 signals growing market confidence, with the token now trading at $4,719—a 3.58% daily gain. The asset has maintained consistent support between $4,300-$4,400, with analysts eyeing $5,000 as the next psychological barrier if resistance at $4,700 breaks.

Meanwhile, Rollblock dominates altcoin discourse after raising $11.7 million in a presale that soared over 500%. The project's community-driven growth model contrasts with speculative rivals, attracting capital seeking fundamentals beyond hype. Ethereum's technical strength, evidenced by its position above key moving averages, provides a stable backdrop for emerging narratives like Rollblock's ascent.

The Overcrowded Ethereum Layer 2 Landscape: Why Most Companies Should Think Twice

Ethereum's layer 2 ecosystem is becoming saturated, with over 150 networks now competing for attention. Despite the allure of launching a dedicated L2—especially compared to the daunting task of creating a new layer 1 blockchain—most enterprises would be better off leveraging existing infrastructure. Ethereum's dominance in DeFi, smart contracts, and real-world asset tokenization remains unchallenged, commanding roughly half of the decentralized finance market even as its L2 ecosystem grows.

Recent entrants like Robinhood highlight the trend of companies seeking to capitalize on Ethereum's security and liquidity while maintaining control over their own networks. Yet the economics of fragmentation are rarely favorable. Layer 2 solutions derive their value from Ethereum's network effects—effects that diminish when spread across hundreds of competing chains. The blockchain's tenth anniversary underscores its resilience, but the L2 gold rush risks creating redundant infrastructure rather than meaningful innovation.

Bitmine Stock Surges 30% on Ethereum Reserve Growth and Institutional Support

Bitmine Technologies (NASDAQ: BMNR) shares rallied 30% this week, rebounding sharply from the $40 level to surpass $55. The surge follows the company's disclosure of holding over 2 million ETH in reserves, valued at nearly $10 billion. Institutional interest intensified as Cathie Wood's Ark Invest acquired 101,950 BMNR shares worth $4.3 million.

Analysts project further upside, with a $110 price target contingent on sustained Ethereum strength. The stock's 15% single-day gain on September 12 reflects growing confidence in Bitmine's ETH-centric treasury strategy, spearheaded by Tom Lee. Despite trading at a premium to its $38 net asset value, demand remains robust.

Ethereum and Rollblock Emerge as Divergent Crypto Opportunities Amid Institutional Demand

Ethereum's resurgence above $4,400 reflects institutional accumulation and technical momentum, with analysts projecting targets up to $9,547. BitMine Digital's $44.5 million OTC purchase and Vitalik Buterin's billion-dollar on-chain activity underscore institutional conviction. Fibonacci levels suggest interim resistance at $5,766 and $6,658.

Meanwhile, Rollblock's 580% presale surge positions it as a high-velocity alternative. Traders speculate the nascent project could deliver 25x returns, outpacing even Ethereum's steady ascent. The protocol's focus on disrupting the $450 billion gaming industry adds narrative fuel to its speculative appeal.

BitMine Strengthens Its Ethereum Holdings with a Major Purchase

BitMine Immersion Technologies has significantly bolstered its corporate Ethereum treasury, acquiring 46,255 ETH worth approximately $201 million in a late-night transaction on Wednesday. Blockchain analytics platform Onchain Lens tracked the movement from a BitGo wallet to three distinct addresses, underscoring the scale of this strategic accumulation.

The company's Ethereum reserves now stand at 2,126,018 ETH, valued at roughly $9.3 billion. This aligns with BitMine's ambitious target to control 5% of Ethereum's total supply, cementing its position as the foremost institutional holder of the cryptocurrency. Earlier this week, BitMine reported holdings of 2.069 million ETH alongside a $20 million investment in Eightco Holdings (OCTO).

Nasdaq-listed Bitmine Purchases $201M ETH, Ethereum Price Today Hits $4,400

Ethereum's institutional adoption reaches new heights as Bitmine Immersion Technologies, a Nasdaq-listed company, acquires 446,255 ETH worth $201 million. The purchase, executed through custodian BitGo on September 10, propels Bitmine to become the largest corporate holder of Ethereum globally.

The market responded swiftly to the news, with ETH's price surging nearly 3% to trade above $4,410. Bitmine's aggressive accumulation strategy now gives it control of 2.1 million ETH, valued at $9.3 billion - putting the company on track to own approximately 5% of Ethereum's total supply.

Chairman Thomas Lee's strategic vision positions Bitmine at the forefront of Ethereum's growth narrative, mirroring MicroStrategy's dominant position in Bitcoin. This move signals deepening institutional confidence in Ethereum's long-term value proposition.

Ethereum Whale Activity Sparks Rally as Analysts Target $7,500

Ethereum breached a critical resistance zone between $4,089 and $4,283, with bullish momentum now eyeing the $7,000-$7,500 range. Market analyst Yusuf AYHAN suggests an extended target of $11,000 should the current uptrend sustain.

Whale wallets accumulated over 450,000 ETH last week while smaller investors offloaded 500,000 tokens—a classic divergence between smart money and retail. Exchange reserves dropped by 260,000 ETH since September, signaling tightening supply amid growing demand.

The $4,500 level proved a temporary barrier after ETH broke its descending triangle pattern. Futures markets show record-low net taker volume, with bears attempting to stall the rally.

Ronin Network Adopts OP Stack to Strengthen Ethereum Integration

Ronin Network, a key player in blockchain gaming and NFTs, is integrating Optimism's OP Stack to evolve into an Ethereum Layer 2 solution. The move aims to enhance scalability and security while aligning with Ethereum's ecosystem.

The transition follows Ronin's 2022 security breach, positioning the upgrade as both a technical necessity and a strategic growth opportunity. Developers gain access to Ethereum's tooling, while users benefit from faster, cheaper transactions.

This integration mirrors similar L2 adoptions by Uniswap and Coinbase, signaling broader industry momentum toward Ethereum scaling solutions. The multi-month migration process underscores the complexity of transitioning a live gaming ecosystem.

Ethereum Gains Momentum Ahead of Fusaka Hard Fork

Ethereum's price surged to $4,356.94, marking a 1.53% increase in 24 hours amid growing anticipation for the Fusaka upgrade. Trading volume spiked 70%, signaling renewed market confidence despite a marginal 0.39% weekly dip.

Network activity reinforces the bullish sentiment, with daily active addresses climbing to 645,000. Developers aim to enhance validator efficiency through the upgrade, mirroring previous post-Dencun price rallies. "The volume surge reflects positioning for potential upside," noted a market analyst.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market fundamentals, Robert from BTCC provides the following Ethereum price projections:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,200 | $5,800 | $6,500 | Fusaka hard fork, institutional adoption |

| 2030 | $8,000 | $12,000 | $18,000 | Layer 2 scaling, DeFi maturation |

| 2035 | $15,000 | $25,000 | $40,000 | Enterprise adoption, tokenization |

| 2040 | $30,000 | $50,000 | $75,000 | Global reserve asset status |

These projections assume continued network development, growing institutional participation, and successful scaling solutions. Robert cautions that regulatory developments and macroeconomic factors could significantly impact these trajectories.